Amiwero Writes CBN on E-Invoicing for Imports, Export, Says Policy Contravenes CEMA Act

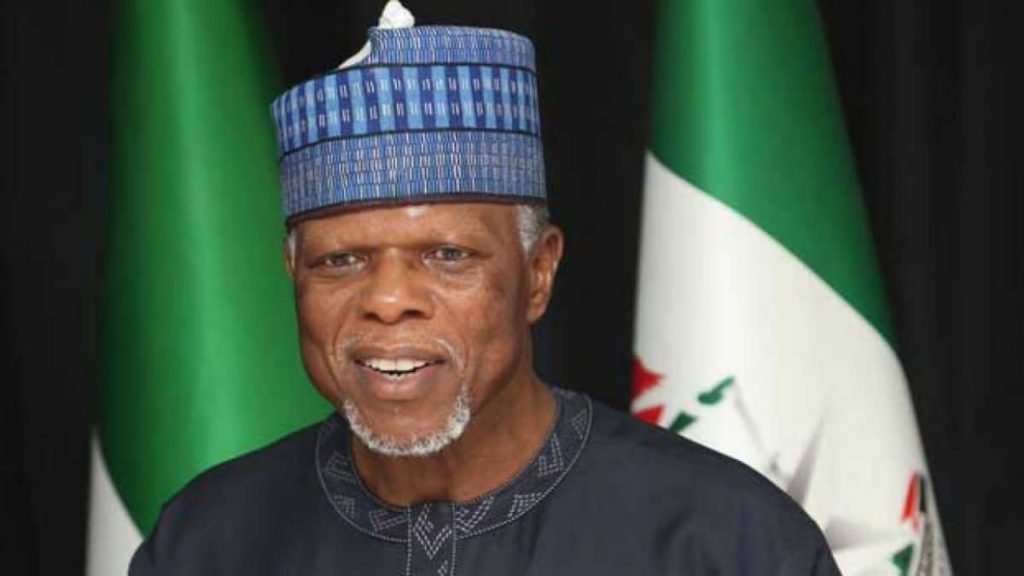

HAMMED ALI CUSTOMS CG

*Condemns duty benchmarking by Customs

By Francis Ugwoke

The National President of the National Council of Managing Directors of Customs Agents (NCMDCA), Mr Lucky Amiwero has drawn the attention of the Central Bank of Nigeria to its guideline on the introduction of e-valuation and e-invoicing.

Amiwero in the letter to the CBN Governor dated January 29, said that guideline was a contravention of the Nigeria Customs and Excise Management (Amendment) Act 20 of 2003.

Amwiero said “valuation of goods in Nigerian is prescribed under the Customs and Excise Management(admendment) Act 20 0f 2003, which gave the power of treatment, process, procedures and determination of valuation of goods under the Act, based on Transaction value method, with six sequential application of 16 paragraphs which state as follows: Transaction value of good general( paragraph 1)

Transaction value of identical goods (paragraph 2)

Transaction value of Similar goods (paragraph 3)

Deductive/ Sale value of goods (paragraph 4)

Computed value of goods (paragraph 5)

Reasonable means/ Fall back Method of Value (Paragraph 6)”.

Amwiero argued that the “ determination of valuation of imported goods, is as contained in the hierarchical principle of application on treatment of valuation of Imported goods, based on the domestication of the agreement on world Trade Organization (WTO) under GATT Articles IIV as an Act under Section 12 of Nigerian constitution as Customs and Excise Management (amendment) Act 20 of 2003 .

“The act is only the legal instrument for the treatment, procedure and application of imported good in Nigeria no other law or agency have the power to introduce strange principle not backed by any law,

“This law provides the primary basis for determination of the valuation of good which is based on transaction value, for price actually paid and payable, which is the global application for treatment of valuation of goods”

The letter added that the “ power to give guideline on Import and Export is domicile under the office of the Minister of Finance as proscribed in Section 36 and 57 of the Customs and Excise Management ACT C 45 of 2004”.

“The regulation of importation in to Nigeria, by sea, air and land borders is exercised by the Minister of Finance who prescribed various procedures for both Import and Export , it is only the Minister of Finance that have the power to prescribe the type of procedures, documentation, either electronic or manual on import and Export not the central bank.

“The guideline from central Bank contravenes the law on valuation of goods on Import the regulation on procedure and Issuance of Import and Export guideline, which is the propagative of the Minister of Finance, there is no provision that gave Central Bank the power on the issuance of guideline on Import and Export, especially when Central Bank main function is on monetary policywith regards to specifically exchange rate., Central

bank should not duplicate the function of Finance and Customs on value procedures determination, invoice, documentation, and electronic application”.

The customs agent also condemned the application of benchmark to importation or exportation by the Customs Service, saying this contravenes the Customs and Excise Management(Amendment) Act 20 of 2003 operated under GATT valuation agreement Articles IIV of world trade organization(WTO).

He added, “ Benchmark is not acceptable, its treatment is under the Brussel definition of value (BDV) that is outlawed globally and Nigerian based on global application of GATT valuation Agreement domesticated under Customs and Excise Management(Amendment) Act 20 of 2003, is the legal and proper application for the valuation of goods

“As member of Central Bank committee on Destination inspection in 1999, presidential committee on Destination Inspection in 2006, Member Presidential Task Force for the Reform of Nigeria Customs Service, member Committee on Import Clearance Procedures and implementation of Fiscal policy Measures 2013, we request that the law should be obeyed by withdrawing the circular, which is not inline with Import and export procedures in Nigeria”