CBN Dumps BDCs, Releases $200m to Banks over Increasing Forex Demand,

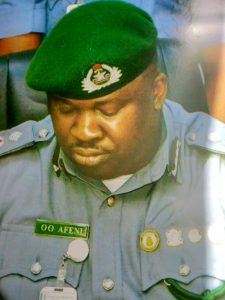

CBN GOVERNOR

*Cries out over fraudulent activities of BDCs

*Laments monthly import bill of N917.6 billion

The sum of $200 million was Tuesday released to commercial banks by the Central Bank of Nigeria (CBN) over increasing dollar demand by Nigerians.

The banks are to ensure that legitimate end users such as Nigerians who want to pay school fees abroad or travel have their dollar needs attended to.

The decision was also part of the decision by the CBN to end sales of forex to the Bureau De Change (BDC) operators who are being accused of fraudulent practices.

The CBN Governor, Mr. Godwin Emefiele, told newsmen in Abuja that the apex banks will stop selling forex to BDCs after a meeting of the Monetary Policy Committee (MPC).

Emefiele said that banks are to create designated branches nationwide where forex could be sold to customers who have legitimate needs.

He disclosed that the apex bank will no longer issue new licences for BDC operations, adding that licences being processed have been suspended.

He also said that banks can now start accepting forex cash deposits from their customers.

He said the decision against selling forex to the BDC was as a result of dubious and unwholesome practices.

He said that while the BDCs buy dollars at N197 per dollar, they sell to their customers at N250.

He explained that it was this unwholesome practice that has made BDC which was 74 in 2005 increase to 2,786 BDCs currently, adding that the application for licensing of new BDC was close to 150.

He also disclosed that even with dwindling oil revenue, the current monthly import bill in the country is N917.6 billion.

He accused the BDC of abandoning the set objectives.

THISDAY Newspaper quotes Emefiele saying, “They are now agents that facilitate graft and corruption in the country. We cannot continue with the bad practices that are happening at the BDC market.

“Several international organisations, embassies, patronise BDC through illegal forex dealers to fund their institutions. We will deal ruthlessly with Nigerian banks that deal with illegal BDCs and we will report foreign organisations patronising them.”

“The public should note that once a customer provides basic documentation to purchase FX, all banks must immediately meet that on demand or within a stipulated timeframe sell foreign exchange to the customer.

“Any customer who doesn’t receive FX along these lines must report this to their banks and where they are unsatisfied with the resolution, they are required to contact the CBN on out toll free line 07002255226 or email cbd@cbn.ng to lodege the complaints with details of the bank transaction.

“The CBN and the government cannot continue to allow this unwholesome practice to continue in Nigeria .

“In total disregard for the policies that the CBN introduced to meet its mandate of safeguarding the value of the naira, we have continued to observe that stakeholders in some sectors have not been helpful in this direction.

“In particular, we have noted with disappointment and great concern that our BDC operators have abandoned the original objectives of their establishment, which was to serve retail end users who need $5,000 or less.

“Instead, they have become wholesale dealers dealing in forex to the tune of millions of dollars per transaction. Despite the fact that Nigeria is the only country in the world today where a central bank sells dollar directly to BDC operators.

“Operators in Nigeria’s bureau de change segment have not reciprocated the bank’s gesture to help maintain price stability to the large market.

“Whereas, the bank has understanding with BDC operators that they make small margins from the US dollar allocated to them, they have reneged and become somewhat greedy, recalcitrant with abnormal high profit sale while ordinary Nigerians have been left to feel the pain and therefore suffer.

“Rather than work to achieve the laudable objectives for which they were licensed, the bank has noted the following unintended but unfortunate outcomes.

“Increase in operators only interested in wider margins and profits from the forex market regardless of prevailing rates in the market.

“Gradual dollarisation of the Nigerian economy with attendant adverse consequences on the conduct of monetary policy and subversion of the cashless policy initiatives of the CBN.

“Our examiners are currently looking at the books and we have reports that indict embassies, international organisations who instead of selling their FX to the recognised investors and exporters’ window have resorted into operating with illegal FX dealers in contravention of our laws.

“And we will deal ruthlessly with Nigerian banks who have acted as collaborators with these forex dealers because they’ve allowed their banking and payment systems infrastructure to be used to facilitate these illegal dealing in foreign exchange.”

“As for those foreign organisations involved, we will report them to their regulators, we will write to those organisations. These unintended outcomes have placed unsustainable financial burden on the CBN and had limited foreign exchange.”