Assessing 8 Years Administration of Retd Col Hameed Ali as Customs Comptroller General

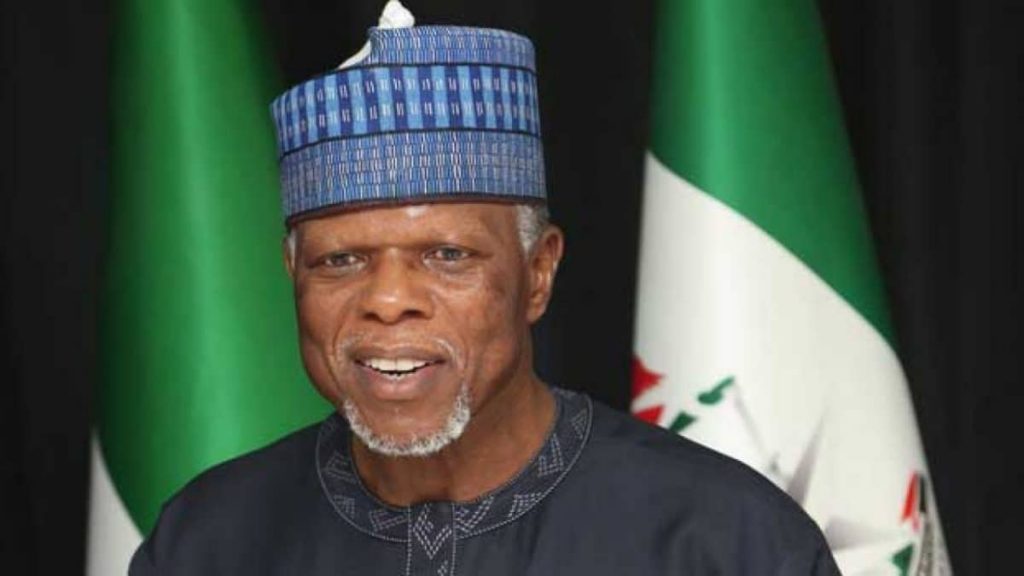

HAMMED ALI CUSTOMS CG

By Dr. Eugene Nweke

BEING AN INDEPENDENT ADMINISTRATION ASSESSMENT OF THE EIGHT (8) YEARS TENURE OF THE IMMEDIATE PAST OF COMPTROLLER GENERAL OF CUSTOMS:.

1.0. PREAMBLE :

10th June, 2023 marked the end of administration tenure and headship of now the former Comptroller General of Customs, following a presidential pronouncement by the President, Commander in Chief of the armed forces of the federal republic.

This modest is a professional commitment towards the betterment of the industry, as it intends to assess the “change mantra” echoed and introduced at the emergence and entrance of the immediate past CGC in 2015, this being his administration agenda for the Nigeria Customs Service.

To add meaning to the policy thrust, he also summarized the policy thrust into “3Rs” (Reform, Restructure and Revenue). Therefore, this modest shall revisit and dwell on the “3Rs”, by undertaking an overview and impact reassessment of the “3Rs” in the context of economic activities and industry concerns, especially to the citizens in general.

It is also important to state that, the new APC administration in 2015 had a mindset with regards to tackling corruption related issues, which informed the new APC administration idea and choice of a retired military officer (a colonel) to preside over the organization’s leadership, as a subtle way of humbling the officers.

Was this idea or choice achieved in the long run?. This is also the concern and the import of this modest.

2.0. ESTABLISHING A BACKGROUND:

It will be recalled that, in 2015, the former CGC inherited a most vibrant Nigeria Customs Service with its technological modernization progression globally recognized, endorsed , recommended, packaged and sold to other Customs administration of the world, by the World Customs Organization – WCO.

For emphasis, the previous administration undertook a giant stride at retrieving back its essential and core functions and information technology development from the Scanner Service Provider ( SSPs), which was a migration from the pre-shipment inspection agents on one hand and the Webfotane on the second hand, that hijacked the core functions of Customs imports and exports inspection, classification and valuation and information technological advancement for several years.

It is on record that, the so-called consultants/contractors apart from being noted for non-prompt delivery or contracts discharges in accordance with the entered contract terms, it is on public purview that, the over 12 years of these statutory function hijack by the contractors did more harm to the Customs and the economy in general, than good.

3.0. THE PAAR SYSTEM AS A BENCHMARK FOR CUSTOMS MODERNIZATION EFFORTS:

The past administration then, undertook an initiative to evolve a home grown technological, pursuance to its modernization vision which was consistent with global best practices as recommended by the WCO Revised Kyoto Convention of the WCO on the simplification and harmonization of Customs Procedures and the WTO Trade Facilitation Agreement, hence, the development and introduction of the Pre Arrival Assessment Report – a world class system to handle Pre Arrival Customs Clearance Processing across the international frontiers, as a security counteracting measures and trade facilitation tool.

For emphasis, in 1st December, 2013 PAAR phase was successful deployed into the import Clearance Process. This was graduated to a new portal known as the enhanced PAAR Platform which was effectively deployed on the 19th March, 2014. Subsequently, implementation processes and attainments gained the management desire to be a model administration with excellence in providing effective and efficient services to the trading community, while achieving graduated trade compliance processes.

Wherefore, the major initiatives and milestones recorded then, includes but not limited to:

a). Introduction of Robust Revenue Intervention Mechanism.

b). Fast Tracking of Compliant Traders Based on WCO SAFE-Framework of Safe Standards ( Autorised Economic Operators Concept – AEO Concept).

c). Timely Issuance of PAAR.

d). Consistent Internal and External Capacity Building Initiatives.

e). Building a Dynamic Risk Management Engine.

f). Entrenching the Culture of Professionalism and Quality Control.

4.0.. THE FUTURE MODERNIZATION DEVELOPMENT AND IMPLEMENTATION PLANS – PREMISED ON THE SUSTENANCE OF AN ENDURING INFORMATION TECHNOLOGIES AND SYSTEM ADVANCEMENT:

The then Management set forth a ‘Future Development Plans’ aimed at the technological advancement and sustenance of the modernization efforts, the PAAR Ruling Centre was positioned to implement the following programmes so as to continuously ensure, optimal output and seamless trade facilitation:

1). Full integration of the Destination Inspection Service i.e. ︎via the deployment of Scanning and PAAR into the cargo processing and clearance processes.

2). Onshore/Offshore capacity building for PRC ( PAAR Ruling Centre) Management , Technical Team and other officers to constantly keep them abreast with modern tools and international best practices.

3). Working out modalities to adopting the “Indian Customs Model”, by sending NCS officers as attache’ “Prize Analyst” to chambers of commerce of countries with high volumes of imports to Nigeria.

4). Establishment and maintenance of a comprehensive and computerized Customs Risks Management System ( CRMS), fully integrated with relevant regulatory and security agencies such as NAFDAC, NAQS, SON, NSA, etc, to guarantee effective profiling of importers for targeting and informed intervention that would guarantee trade facilitation without jeopardizing national security and revenue.

5). Establishment of a world class Data Centre fully equipped with Back-ups, Disaster recovery plan, fire or water detection system and security controls.

On subsequent performance to the implementation, it must be stated that, compliance level of the trading public to national trade law was at the progression, from 20% to 35% and was expected to hit above 50% if the management had adhered with its commitment to the implementation of the future development plan of the PAAR system and sustained by the PAAR Ruling Centre, unfortunately non-compliance to trade laws has gone below 20%

It is on this note, that, this modest, wishes to set-forth a backgrounds to restate that the former Comptroller General, inherited an organization’s which well-being and capacity is nationally and internationally recognized, hence, it took over its reigns as the chief administrator of the Nigeria Customs Service, with a ” 3Rs”( Reform, Restructure and Revenue ), driving the management policy thrust.

5.0. EXPECTED TRADE AND CONCEPT ADMINISTRATIVE IDEALISM:

The Following administration idealism was expected from the management for the sustenance of the modernisation process under the PAAR Ruling Centres, pursuance to the future development and modernization plans:

Firstly, the vision and essence of the PAAR Concept, targeted the implementation of an Automated Commercial Environment aka NICIS Levels, with the Customs Ports and Trading space, in phases.

NICIS 1&2 is expected to provide a technology foundation for all modernisation programmes and delivery, for enhanced support of the cargo processing and enforcement operations.

Ideally, the Implementation of an automated commercial environment with inherent major business functions are the responsiveness and effectiveness within the Customs Ports, especially, in relation to the emerging trends in the international trade environment.

Secondly, is the critical concern aimed at evolving a Robust User Friendly Portal ( high connectivity and interactiveness) prone to free access and devoid of monopoly and limitations.

Thirdly, prompt management and traders interface in accounting & transactions, in accordance with the relevant provisions of the WTO general agreement on trade and tariff ( GATT’ 94), especially on the imports administration ( Agreed Customs Administration – ACV 20, contained in the First Schedule of the CEMA, CAP 45.

Fourthly, establishing a baseline for cargo processing and electronic release ( e-release) via a Time Release Study application.

Fifth, the enhancement of security and enforcement objectives – soliciting international partnership towards container security initiatives ( CSI).

Unfortunately, instead of reassembling the trained officers pursuance to item 4.0. above, in a manner that suggests a self-defeat, the former Comptroller general opted for e-custom modernization concession project.

6.0. NOTICEABLE OF CONCERNS EIGHT YEARS DOWN THE LINE:

Eighth years down the line, need for a careful and critical analysis of the 3Rs ( Reform, Restructure and Revenue) of the immediate past administration agenda via operational system study and review – pre and post doing so in parentheses within the past eight ( 8) years, viz-a-viz:

a). Revenue Generation Vs Industry Growth.

b). Anti-smuggling Vs Increased Insecurity & Challenges.

c). System Automation Vs Operational Impunity.

d). International Representation Vs Regional Development.

e). Policy Enforcement Vs National Poverty Index.

f).. Staff Welfare Vs Corporate Integrity.

g). High Revenue Generation Performance Vs National Inflation & Non Competitiveness.

For the sake of press statement space and public readers time and attention, the modest will do a general retrospective, but shall be detailed is subsequent bulletins.

7.0. EIGHT YEARS IN RETROSPECT:

However, among the 3Rs the most outstanding “R” is the “R” for = revenue generation, which constituted the administration core focus even as performance measuring yardstick. Indeed, the administration will be remembered for higher revenue generation records but, without a predictable and corresponding cargo throughput growth per year, recorded under the regime.

Regrettably, higher revenue without recourse to the impacts analysis on the overall economic well-being of the citizens and trading community in relation to the; ever increasingly foreign exchange regime, inflation, capital flight, thriving hardship in the businesses climate, lower purchasing power of the citizens, etc

In the context of the above, the import and necessity for the E-Customs modernisation concession project became suspicious to as many who had followed the modernisation trends and intrigues in the Nigeria Customs Service.

While the World Customs Organization – WCO is encouraging global Customs nations to develop, adopt and implement a SMART BORDER CONCEPT towards the improvement and sustenance of modernization processes, the Nigeria Customs Service under the immediate past headship, resorted to concession its modernization processes to a foreign firm under a joint venture window.

Without mincing words the larger stakeholders considered the step as a deliberate and ambitious intent reordering or reinventing of another repackaged and reintroduction of the cargo pre shipment inspection arrangements, for a 25years contract period. The question is, where are the officers that developed the PAAR concept? Where are the officers trained in India as noted in item 4 above? Does it mean that the ICT Officer of the Service lacks the technical no how to further improve on the existing platform committedly?.

Here again, this ambitious e-custom modernization concession project, seems to have whittled down any other feasible achievement recorded by the immediate past Customs administration, with reference to its policy thrust.

8.0. NEED TO CLARIFY THE SENTIMENTS ON HIGHER REVENUE GENERATION HYPES:

To clarify this revenue higher generation sentiments, it is important to put in the right perspective the two scenarios occasioned by forex regimes, under a comparative six (6) years annual revenue generation per regime. Notably, available records shows that, the Nigeria Customs Service generated a total of N13, 254illion from 2010 to 2021. The breakdown per six years comparative regimes, are as follows:

8.1. A. The data shows that, during the past career Customs administrator 2010 to 2015, the NCS generated, thus

a). 2010 = N546.64 billion <> @ official forex rate of 1$ = N126 to N197.

b). 2011 = N741.83 billion <> @ official forex rate of 1$ = N126 to N197.

c). 2012 = N850.88 billion <> @ official forex rate of 1$ = N126 to N197.

d). 2013 = N833.4 billion <> @ official forex rate of 1$ = N126 to N197.

e). 2014 = N977 billion <> @ official forex rate of 1$ = N126 to N197.

f). 2015 = N903 billion <> @ official forex rate of 1$ = N126 to N197.

Subtotal revenue generated by the past career Customs administrator: = N4, 972,750,000,000.00.

8.2.. The data shows that, under the present non career Customs administrator, 2016 to 2021, the NCS generated, thus:

a). 2016 = N899 billion <> @ official forex rate of 1$ = N126 to N197.

b). 2017 = N1.03 trillion <> @ official forex rate of 1$ = N232 to N430

c). 2018 = N1.2 trillion <> @ official forex rate of 1$ = N232 to N430

d). 2019 = N1.34 trillion <> @ official forex rate of 1$ = N232 to N430

e). 2020 = N1.6 trillion <> @ official forex rate of 1$ = N232 to N430

f). 2021 = N2.24 trillion <> @ official forex rate of 1$ = N232 to N430

Subtotal revenue generated under the present non Customs administrator : N 8,282,000,000,000:00.

8.3. CALCULATION:

The calculation to determine differences in relation to 2010 to 2015 regime given the same high exchange rate:

a). #4.972,750,000,000:00 ÷ #197 = #25, 242,385, 786: 00 × #430 (current exchange rate) = #10, 854,225,890,000:00. ( #10 trillion).

b). #8,282,000,000,000;00 ÷ #430 = #9,260,465,116:000 × #197 (old exchange rate) =

8.4. SUMMARY:

1 Total Revenue Collection Career Customs Administrator From2010 to 2015 = N4,972,000,000,000:00 (N4.9Trilion) at Forex rate of $1/N126 to N197.

2. Total Revenue Collection Non Career Customs Administrator From 2015 to 2021 = N8, 282,000,000,000:00 (N8.2Trilion) at Forex rate of $1/N232 to N430.

3. Difference In Collection + N3,309 250,000,000:00 (N3.3Trilion).

4. Logically given same scenario of 2015 to 2021, if you juxtapose by multiplying the differences in higher forex regime in the excess of N233 to the total collection generated in 2010 to 2015 N4,972,750,000,000:00 = N1,158,650,750,000,000:00.

5. In a nutshell, from the item 4 of the above, the total yearly revenue generation performance is not the only determinant factor for effective yearly Customs administration performance rating.

6. It therefore, suffices to state that, if the Customs Carrier Administration were to bask on the euphoria of higher forex regime of $1to #430 , it will have generated in approximation as much as #10 Trillion.

8.5. EXPLANATIONS ON NOTABLE INCIDENCES WITHIN THE PERIOD UNDER REVIEW:

1. The CBN subjected the importers of over forty one (40) regular import products to procure forex @ $1 to N750 at the Parallel markets and accounts same to the Commercial Banks.

2. The CBN approved an official forex rate at $1 = N232 to N430 for revenue purposes, government transactions and the Bureau De Change Agent ( making more profits than the international trading public).

3. The difference between the parallel market rate and the official rate ($1 to N750 – N430) is at an arbitrage of N320.

4. The difference between the prevailed forex in 2010 to 2015 and the prevailing forex in 2016 to 2021 parallel market rate and the official rate ($1 to N750 – N430) is at an arbitrage of N320.

5. The forex rate margin between the career Customs administration regime ( 2010 to 2015) and the non Customs career regime (2015 to 2021) is $1 to N233.

9.0. ADMINISTRATIVE LEGACIES OF NOTE:

9.1. Deployment of Military Strategies “straight jacket approach” in revenue generation, especially, as it bothers on the determination of value of an imported goods into the country, for example:

i). The resort to tactically assign a supposedly, an ad-hoc committee or task forces a permanent administrative status as against an interventionist arrangement status, thereby usurping the functions of the line (unit) officers, this includes the ; CGC Roving Team; CGC Monitoring, CGC Tasks force, etc., while the statutory functions of the F.O.U. remains optimal.

ii). The Illogical Creation of the Customs Police outside the statutory provisions without a clear mandate, different from the statutory functions of the Customs Enforcement Units and Customs Investigation Units, in fact it is a subtle way to under scoring the obvious “vote of no confidence” on the Customs Investigation Units, Enforcement and Valuation Units.

iii). The abuse of Cargo Alert system beyond the established PAAR Ruling Centre arrangement, which abinitio serves as the centralized and domiciled with the PAAR Ruling Centre – System Audit task.

9.2. Application Of Benchmarking System On Imported Goods Into The Country – An Indirect Jettisoning Od The Provisions Of The First Schedule ( Section 45.2003 No.20) Of The Customs And Excise Management Act – CEMA CAP.C45:

The said provision set forth the global standards practices, requisite procedures and applicable treatments in determining the Value of Imported Goods into the Country ( which is a domestication of Section 20 of the World Trade Organization/General Applications Of Trade & Tariff, with the subtitle: Agreed Customs Valuation -20).

In a bid to maximize revenue generation, this legislative provisions was jettisoned without recourse, and in its place was the adoption a benchmark system @ a 20footer Container Import billed to pay an initial duty imposition #2milion upon declaration before physical examination or scanning operation, while 40footer Container import billed to pays an initial duty imposition of #4million. This benchmarking system is applicable to imports requiring the processing and issuance of Pre-Arrival Assessment Report, for the purpose of effecting payable customs duty.

Take note that, in the course of further cargo examination and clearance processes, the same cargo is subjected to vagaries of cargo alerting for both additional duty payments, extortion and exploitation, which ordinarily should not be, if the right administrative cargo security initiatives was adopted.

More worrisome, under the benchmarks system, used items imports without a standard known value is now subjected to paying the same imposition as a new finished product importation.

10.0. IMPACT OF HIGHER REVENUE GENERATION WITHOUT A CORRESPONDING CARGO THROUGHPUTS AND ECONOMIC DEVELOPMENT INDICES:

Firstly, the non-offering of an analyzed and right professional advice Or inputs to the federal government during policy formulation, for Instance, on such fiscal

policies in the areas of :

i). Closure Of International Borders by the President.

ii). Uploading and Gazetting Of Over 43 Common Import Items And Blacklisting Same from Accessing Foreign Exchange From The Commercial Banks

Though outstanding revenue performances were recorded, unfortunately, in the long run, failure to advise and quick to enforce the fiscal policies and some noticeable internal illogical policies, had either by direct or indirect involvement, resorted to the following national concerns:

• High Revenue Collection – contributes to the low Foreign Direct Investment in to the Country.

• High Revenue Collection – led to the higher number of factories under closures.

• High Revenue Collection – contributes to increased unemployment rate.

• Higher Revenue Collection – breeds a higher Inflation rate regime.

• Higher Revenue Collection – breeds or triggered an increased Red Tapes/Technical Barriers To Trade, e.g. Transfer of Pricing, Compromised Physical Examination Of Cargo ( aka open and close) of container for at a standard fees, hyper incidences of import concealments, over invoicing, compromised temporary importation applications, etc.

• Higher Revenue Collection – breeds increased rate of malpractices & impunity at operational base.

• Higher Revenue Collection – combined with higher foreign exchange rate breeds trade distortion and poverty.

• Higher Revenue Collection – breeds comparative low cargo throughput.

• Higher Revenue Collection – breeds an Increased rate Of Insecurities/Drug trafficking.

• Higher Revenue Collection – promotes an increased smuggling activities.

• Higher Revenue Collection – promotes an Increased casualties on the part of officers .

• Higher Revenue Collection – responsible for the increased seizures of trade goods and contraband goods.

• Higher Revenue Collection – promotes an increased import racketeers and cartels activities in the system.

• Higer Revenue Collection – contributes by an infraction the increased poverty rate amongst citizens as published by international ranking.

• Higher Revenue Collection – Contributes to meaningfully to longer cargo dwell time at the ports, especially so relation to haggling and high handedness on the part of operational officers. Thereby contributing an infraction to port costs factor.

11.0. THE BREAKDOWN OFTHE 25Year REVENUE GENERATION ESTIMATES OF $200 COURTESY OF THE E-CUSTOM MODERNIZATION MODERNIZATION CONCESSION – REEMPHASISING ON ITS IMPLICATIONS :

HIGHLIGHTS OF THE PROJECT:

11.1. 1. $200,000,000,000:00b ÷ 25 Yrs = $8,000,000,000:00b. Per Annum.

Conversion @ 1$/#475.

2. #95,000,000,000,000:00Trillion ÷ 25Yrs =#3,800,000,000,000:00Trillion Per Annum.

3. $8,000,000,000:00b ÷ 12Months = -$667,000,000:00m Per month.

Conversion @ $1/#475:

4. #3,800,000,000,000:00Trillion ÷ 12Months = #316,825,000,000:00billion Per month.

11.2. SUMMARY OF E-CUSTOMS PROJECTED REVNUE GENERATION:

a). Monthly Revenue Projection =#316,825,000,000:00billion Per month/ -$667,000,000:00m Per month.

b).Yearly Revenue Projection = #3,800,000,000,000:00Trillion/ $8,000,000,000:00b

c). 25 Year Revenue Projection = #95,000,000,000,000:00Trillion / $200,000,000,000:00b

11.3. POSSIBLE DETERMINING FACTORS TO REVENUE FORECASTS OF THE CONSULTANT: The Projection is a probability owing to the following possible determining factors, which the consultant don’t have monopoly over it:

1. Foreign Exchange Administration.

2. Cargo Throughput forecast.

3. AfCTA Regime Implementation.

4. Government Fiscal Policy on trade.

5. Secured Supply Chain – Trade Compliance Questions.

11.4. ADMINISTRATIVE CHALLENGES:

1. Firstly, it is a common practice of the consultants to project an attractive and bogus revenue projection/forecast to earn government interests and patronage, afterwards they will start given reasons for not meeting its set targets in line with milestone actualization plan. A typical example is the projected aims and objectives of the port concession program of 2006.

2. Irrespective of the packaging of this project, it is a calculated and subtle return of the Nigeria Customs Service to a preshipment inspection regime, no matter the disguise of nomenclature, so applied.

3. From record, the consultant and technical partners does not have any track record of any nation where they have successfully undertaken such practices, as such it is going to be an experiment with the Nigeria Customs, invariably you can’t rule out teething problems and initial related crisis that will trail the commencement.

4. Judging from previous experiences, the key foreseeable crisis that will arise, on grounds of the trading public resistance to over valuation of trade goods, as the consultant is posed to achieve aggressive revenue generation without recourse to international best practices, but with kin and key interests focusing on its 1% comprehensive inspection scheme earnings collections.

5. The one and two above will trigger both trade/throughput disruption further the economic impact of inflation rate on the nation.

6. Only time shall tell.

CONCLUSION:

With the above independent assessment of the administrative impact of the former CGC of customs in the last 8 years to the port industry, this whole essence of this obligation is to sustain the culture of assessing the tenure of officials occupying heading essential agencies in the maritime industry.

While wishing the former CGC of Customs success in his future endeavors, we wish to congratulate the newly decorated Acting Comptroller General of Customs, Adewale Bashir Adeniyi, and to him we say: WELCOME TO A PROFESSIONAL CAREER CUSTOMS ADMINISTRATION REGIME.

Note that this Professional Assessment Position Paper Represents the strong opinion and position of the Sea Empowerment Research Center RGT’ undertaken for industry enhancement via references, comparative reviews and interactive engagements.

Thanks for your attention.

Fwdr Dr Eugene Nweke Rff Fnis Fptm Fffa Fasca Ksm.

@ Head Of Research – SEA EMPOWERMENT AND RESEARCH CENTRE RGT.

26th June 2023.

Ends

BEING AN INDEPENDENT ADMINISTRATION ASSESSMENT OF THE EIGHT (8) YEARS TENURE OF THE IMMEDIATE PAST OF COMPTROLLER GENERAL OF CUSTOMS:.

1.0. PREAMBLE :

10th June, 2023 marked the end of administration tenure and headship of now the former Comptroller General of Customs, following a presidential pronouncement by the President, Commander in Chief of the armed forces of the federal republic.

This modest is a professional commitment towards the betterment of the industry, as it intends to assess the “change mantra” echoed and introduced at the emergence and entrance of the immediate past CGC in 2015, this being his administration agenda for the Nigeria Customs Service.

To add meaning to the policy thrust, he also summarized the policy thrust into “3Rs” (Reform, Restructure and Revenue). Therefore, this modest shall revisit and dwell on the “3Rs”, by undertaking an overview and impact reassessment of the “3Rs” in the context of economic activities and industry concerns, especially to the citizens in general.

It is also important to state that, the new APC administration in 2015 had a mindset with regards to tackling corruption related issues, which informed the new APC administration idea and choice of a retired military officer (a colonel) to preside over the organization’s leadership, as a subtle way of humbling the officers.

Was this idea or choice achieved in the long run?. This is also the concern and the import of this modest.

2.0. ESTABLISHING A BACKGROUND:

It will be recalled that, in 2015, the former CGC inherited a most vibrant Nigeria Customs Service with its technological modernization progression globally recognized, endorsed , recommended, packaged and sold to other Customs administration of the world, by the World Customs Organization – WCO.

For emphasis, the previous administration undertook a giant stride at retrieving back its essential and core functions and information technology development from the Scanner Service Provider ( SSPs), which was a migration from the pre-shipment inspection agents on one hand and the Webfotane on the second hand, that hijacked the core functions of Customs imports and exports inspection, classification and valuation and information technological advancement for several years.

It is on record that, the so-called consultants/contractors apart from being noted for non-prompt delivery or contracts discharges in accordance with the entered contract terms, it is on public purview that, the over 12 years of these statutory function hijack by the contractors did more harm to the Customs and the economy in general, than good.

3.0. THE PAAR SYSTEM AS A BENCHMARK FOR CUSTOMS MODERNIZATION EFFORTS:

The past administration then, undertook an initiative to evolve a home grown technological, pursuance to its modernization vision which was consistent with global best practices as recommended by the WCO Revised Kyoto Convention of the WCO on the simplification and harmonization of Customs Procedures and the WTO Trade Facilitation Agreement, hence, the development and introduction of the Pre Arrival Assessment Report – a world class system to handle Pre Arrival Customs Clearance Processing across the international frontiers, as a security counteracting measures and trade facilitation tool.

For emphasis, in 1st December, 2013 PAAR phase was successful deployed into the import Clearance Process. This was graduated to a new portal known as the enhanced PAAR Platform which was effectively deployed on the 19th March, 2014. Subsequently, implementation processes and attainments gained the management desire to be a model administration with excellence in providing effective and efficient services to the trading community, while achieving graduated trade compliance processes.

Wherefore, the major initiatives and milestones recorded then, includes but not limited to:

a). Introduction of Robust Revenue Intervention Mechanism.

b). Fast Tracking of Compliant Traders Based on WCO SAFE-Framework of Safe Standards ( Autorised Economic Operators Concept – AEO Concept).

c). Timely Issuance of PAAR.

d). Consistent Internal and External Capacity Building Initiatives.

e). Building a Dynamic Risk Management Engine.

f). Entrenching the Culture of Professionalism and Quality Control.

4.0.. THE FUTURE MODERNIZATION DEVELOPMENT AND IMPLEMENTATION PLANS – PREMISED ON THE SUSTENANCE OF AN ENDURING INFORMATION TECHNOLOGIES AND SYSTEM ADVANCEMENT:

The then Management set forth a ‘Future Development Plans’ aimed at the technological advancement and sustenance of the modernization efforts, the PAAR Ruling Centre was positioned to implement the following programmes so as to continuously ensure, optimal output and seamless trade facilitation:

1). Full integration of the Destination Inspection Service i.e. ︎via the deployment of Scanning and PAAR into the cargo processing and clearance processes.

2). Onshore/Offshore capacity building for PRC ( PAAR Ruling Centre) Management , Technical Team and other officers to constantly keep them abreast with modern tools and international best practices.

3). Working out modalities to adopting the “Indian Customs Model”, by sending NCS officers as attache’ “Prize Analyst” to chambers of commerce of countries with high volumes of imports to Nigeria.

4). Establishment and maintenance of a comprehensive and computerized Customs Risks Management System ( CRMS), fully integrated with relevant regulatory and security agencies such as NAFDAC, NAQS, SON, NSA, etc, to guarantee effective profiling of importers for targeting and informed intervention that would guarantee trade facilitation without jeopardizing national security and revenue.

5). Establishment of a world class Data Centre fully equipped with Back-ups, Disaster recovery plan, fire or water detection system and security controls.

On subsequent performance to the implementation, it must be stated that, compliance level of the trading public to national trade law was at the progression, from 20% to 35% and was expected to hit above 50% if the management had adhered with its commitment to the implementation of the future development plan of the PAAR system and sustained by the PAAR Ruling Centre, unfortunately non-compliance to trade laws has gone below 20%

It is on this note, that, this modest, wishes to set-forth a backgrounds to restate that the former Comptroller General, inherited an organization’s which well-being and capacity is nationally and internationally recognized, hence, it took over its reigns as the chief administrator of the Nigeria Customs Service, with a ” 3Rs”( Reform, Restructure and Revenue ), driving the management policy thrust.

5.0. EXPECTED TRADE AND CONCEPT ADMINISTRATIVE IDEALISM:

The Following administration idealism was expected from the management for the sustenance of the modernisation process under the PAAR Ruling Centres, pursuance to the future development and modernization plans:

Firstly, the vision and essence of the PAAR Concept, targeted the implementation of an Automated Commercial Environment aka NICIS Levels, with the Customs Ports and Trading space, in phases.

NICIS 1&2 is expected to provide a technology foundation for all modernisation programmes and delivery, for enhanced support of the cargo processing and enforcement operations.

Ideally, the Implementation of an automated commercial environment with inherent major business functions are the responsiveness and effectiveness within the Customs Ports, especially, in relation to the emerging trends in the international trade environment.

Secondly, is the critical concern aimed at evolving a Robust User Friendly Portal ( high connectivity and interactiveness) prone to free access and devoid of monopoly and limitations.

Thirdly, prompt management and traders interface in accounting & transactions, in accordance with the relevant provisions of the WTO general agreement on trade and tariff ( GATT’ 94), especially on the imports administration ( Agreed Customs Administration – ACV 20, contained in the First Schedule of the CEMA, CAP 45.

Fourthly, establishing a baseline for cargo processing and electronic release ( e-release) via a Time Release Study application.

Fifth, the enhancement of security and enforcement objectives – soliciting international partnership towards container security initiatives ( CSI).

Unfortunately, instead of reassembling the trained officers pursuance to item 4.0. above, in a manner that suggests a self-defeat, the former Comptroller general opted for e-custom modernization concession project.

6.0. NOTICEABLE OF CONCERNS EIGHT YEARS DOWN THE LINE:

Eighth years down the line, need for a careful and critical analysis of the 3Rs ( Reform, Restructure and Revenue) of the immediate past administration agenda via operational system study and review – pre and post doing so in parentheses within the past eight ( 8) years, viz-a-viz:

a). Revenue Generation Vs Industry Growth.

b). Anti-smuggling Vs Increased Insecurity & Challenges.

c). System Automation Vs Operational Impunity.

d). International Representation Vs Regional Development.

e). Policy Enforcement Vs National Poverty Index.

f).. Staff Welfare Vs Corporate Integrity.

g). High Revenue Generation Performance Vs National Inflation & Non Competitiveness.

For the sake of press statement space and public readers time and attention, the modest will do a general retrospective, but shall be detailed is subsequent bulletins.

7.0. EIGHT YEARS IN RETROSPECT:

However, among the 3Rs the most outstanding “R” is the “R” for = revenue generation, which constituted the administration core focus even as performance measuring yardstick. Indeed, the administration will be remembered for higher revenue generation records but, without a predictable and corresponding cargo throughput growth per year, recorded under the regime.

Regrettably, higher revenue without recourse to the impacts analysis on the overall economic well-being of the citizens and trading community in relation to the; ever increasingly foreign exchange regime, inflation, capital flight, thriving hardship in the businesses climate, lower purchasing power of the citizens, etc

In the context of the above, the import and necessity for the E-Customs modernisation concession project became suspicious to as many who had followed the modernisation trends and intrigues in the Nigeria Customs Service.

While the World Customs Organization – WCO is encouraging global Customs nations to develop, adopt and implement a SMART BORDER CONCEPT towards the improvement and sustenance of modernization processes, the Nigeria Customs Service under the immediate past headship, resorted to concession its modernization processes to a foreign firm under a joint venture window.

Without mincing words the larger stakeholders considered the step as a deliberate and ambitious intent reordering or reinventing of another repackaged and reintroduction of the cargo pre shipment inspection arrangements, for a 25years contract period. The question is, where are the officers that developed the PAAR concept? Where are the officers trained in India as noted in item 4 above? Does it mean that the ICT Officer of the Service lacks the technical no how to further improve on the existing platform committedly?.

Here again, this ambitious e-custom modernization concession project, seems to have whittled down any other feasible achievement recorded by the immediate past Customs administration, with reference to its policy thrust.

8.0. NEED TO CLARIFY THE SENTIMENTS ON HIGHER REVENUE GENERATION HYPES:

To clarify this revenue higher generation sentiments, it is important to put in the right perspective the two scenarios occasioned by forex regimes, under a comparative six (6) years annual revenue generation per regime. Notably, available records shows that, the Nigeria Customs Service generated a total of N13, 254illion from 2010 to 2021. The breakdown per six years comparative regimes, are as follows:

8.1. A. The data shows that, during the past career Customs administrator 2010 to 2015, the NCS generated, thus

a). 2010 = N546.64 billion <> @ official forex rate of 1$ = N126 to N197.

b). 2011 = N741.83 billion <> @ official forex rate of 1$ = N126 to N197.

c). 2012 = N850.88 billion <> @ official forex rate of 1$ = N126 to N197.

d). 2013 = N833.4 billion <> @ official forex rate of 1$ = N126 to N197.

e). 2014 = N977 billion <> @ official forex rate of 1$ = N126 to N197.

f). 2015 = N903 billion <> @ official forex rate of 1$ = N126 to N197.

Subtotal revenue generated by the past career Customs administrator: = N4, 972,750,000,000.00.

8.2.. The data shows that, under the present non career Customs administrator, 2016 to 2021, the NCS generated, thus:

a). 2016 = N899 billion <> @ official forex rate of 1$ = N126 to N197.

b). 2017 = N1.03 trillion <> @ official forex rate of 1$ = N232 to N430

c). 2018 = N1.2 trillion <> @ official forex rate of 1$ = N232 to N430

d). 2019 = N1.34 trillion <> @ official forex rate of 1$ = N232 to N430

e). 2020 = N1.6 trillion <> @ official forex rate of 1$ = N232 to N430

f). 2021 = N2.24 trillion <> @ official forex rate of 1$ = N232 to N430

Subtotal revenue generated under the present non Customs administrator : N 8,282,000,000,000:00.

8.3. CALCULATION:

The calculation to determine differences in relation to 2010 to 2015 regime given the same high exchange rate:

a). #4.972,750,000,000:00 ÷ #197 = #25, 242,385, 786: 00 × #430 (current exchange rate) = #10, 854,225,890,000:00. ( #10 trillion).

b). #8,282,000,000,000;00 ÷ #430 = #9,260,465,116:000 × #197 (old exchange rate) =

8.4. SUMMARY:

1 Total Revenue Collection Career Customs Administrator From2010 to 2015 = N4,972,000,000,000:00 (N4.9Trilion) at Forex rate of $1/N126 to N197.

2. Total Revenue Collection Non Career Customs Administrator From 2015 to 2021 = N8, 282,000,000,000:00 (N8.2Trilion) at Forex rate of $1/N232 to N430.

3. Difference In Collection + N3,309 250,000,000:00 (N3.3Trilion).

4. Logically given same scenario of 2015 to 2021, if you juxtapose by multiplying the differences in higher forex regime in the excess of N233 to the total collection generated in 2010 to 2015 N4,972,750,000,000:00 = N1,158,650,750,000,000:00.

5. In a nutshell, from the item 4 of the above, the total yearly revenue generation performance is not the only determinant factor for effective yearly Customs administration performance rating.

6. It therefore, suffices to state that, if the Customs Carrier Administration were to bask on the euphoria of higher forex regime of $1to #430 , it will have generated in approximation as much as #10 Trillion.

8.5. EXPLANATIONS ON NOTABLE INCIDENCES WITHIN THE PERIOD UNDER REVIEW:

1. The CBN subjected the importers of over forty one (40) regular import products to procure forex @ $1 to N750 at the Parallel markets and accounts same to the Commercial Banks.

2. The CBN approved an official forex rate at $1 = N232 to N430 for revenue purposes, government transactions and the Bureau De Change Agent ( making more profits than the international trading public).

3. The difference between the parallel market rate and the official rate ($1 to N750 – N430) is at an arbitrage of N320.

4. The difference between the prevailed forex in 2010 to 2015 and the prevailing forex in 2016 to 2021 parallel market rate and the official rate ($1 to N750 – N430) is at an arbitrage of N320.

5. The forex rate margin between the career Customs administration regime ( 2010 to 2015) and the non Customs career regime (2015 to 2021) is $1 to N233.

9.0. ADMINISTRATIVE LEGACIES OF NOTE:

9.1. Deployment of Military Strategies “straight jacket approach” in revenue generation, especially, as it bothers on the determination of value of an imported goods into the country, for example:

i). The resort to tactically assign a supposedly, an ad-hoc committee or task forces a permanent administrative status as against an interventionist arrangement status, thereby usurping the functions of the line (unit) officers, this includes the ; CGC Roving Team; CGC Monitoring, CGC Tasks force, etc., while the statutory functions of the F.O.U. remains optimal.

ii). The Illogical Creation of the Customs Police outside the statutory provisions without a clear mandate, different from the statutory functions of the Customs Enforcement Units and Customs Investigation Units, in fact it is a subtle way to under scoring the obvious “vote of no confidence” on the Customs Investigation Units, Enforcement and Valuation Units.

iii). The abuse of Cargo Alert system beyond the established PAAR Ruling Centre arrangement, which abinitio serves as the centralized and domiciled with the PAAR Ruling Centre – System Audit task.

9.2. Application Of Benchmarking System On Imported Goods Into The Country – An Indirect Jettisoning Od The Provisions Of The First Schedule ( Section 45.2003 No.20) Of The Customs And Excise Management Act – CEMA CAP.C45:

The said provision set forth the global standards practices, requisite procedures and applicable treatments in determining the Value of Imported Goods into the Country ( which is a domestication of Section 20 of the World Trade Organization/General Applications Of Trade & Tariff, with the subtitle: Agreed Customs Valuation -20).

In a bid to maximize revenue generation, this legislative provisions was jettisoned without recourse, and in its place was the adoption a benchmark system @ a 20footer Container Import billed to pay an initial duty imposition #2milion upon declaration before physical examination or scanning operation, while 40footer Container import billed to pays an initial duty imposition of #4million. This benchmarking system is applicable to imports requiring the processing and issuance of Pre-Arrival Assessment Report, for the purpose of effecting payable customs duty.

Take note that, in the course of further cargo examination and clearance processes, the same cargo is subjected to vagaries of cargo alerting for both additional duty payments, extortion and exploitation, which ordinarily should not be, if the right administrative cargo security initiatives was adopted.

More worrisome, under the benchmarks system, used items imports without a standard known value is now subjected to paying the same imposition as a new finished product importation.

10.0. IMPACT OF HIGHER REVENUE GENERATION WITHOUT A CORRESPONDING CARGO THROUGHPUTS AND ECONOMIC DEVELOPMENT INDICES:

Firstly, the non-offering of an analyzed and right professional advice Or inputs to the federal government during policy formulation, for Instance, on such fiscal

policies in the areas of :

i). Closure Of International Borders by the President.

ii). Uploading and Gazetting Of Over 43 Common Import Items And Blacklisting Same from Accessing Foreign Exchange From The Commercial Banks

Though outstanding revenue performances were recorded, unfortunately, in the long run, failure to advise and quick to enforce the fiscal policies and some noticeable internal illogical policies, had either by direct or indirect involvement, resorted to the following national concerns:

• High Revenue Collection – contributes to the low Foreign Direct Investment in to the Country.

• High Revenue Collection – led to the higher number of factories under closures.

• High Revenue Collection – contributes to increased unemployment rate.

• Higher Revenue Collection – breeds a higher Inflation rate regime.

• Higher Revenue Collection – breeds or triggered an increased Red Tapes/Technical Barriers To Trade, e.g. Transfer of Pricing, Compromised Physical Examination Of Cargo ( aka open and close) of container for at a standard fees, hyper incidences of import concealments, over invoicing, compromised temporary importation applications, etc.

• Higher Revenue Collection – breeds increased rate of malpractices & impunity at operational base.

• Higher Revenue Collection – combined with higher foreign exchange rate breeds trade distortion and poverty.

• Higher Revenue Collection – breeds comparative low cargo throughput.

• Higher Revenue Collection – breeds an Increased rate Of Insecurities/Drug trafficking.

• Higher Revenue Collection – promotes an increased smuggling activities.

• Higher Revenue Collection – promotes an Increased casualties on the part of officers .

• Higher Revenue Collection – responsible for the increased seizures of trade goods and contraband goods.

• Higher Revenue Collection – promotes an increased import racketeers and cartels activities in the system.

• Higer Revenue Collection – contributes by an infraction the increased poverty rate amongst citizens as published by international ranking.

• Higher Revenue Collection – Contributes to meaningfully to longer cargo dwell time at the ports, especially so relation to haggling and high handedness on the part of operational officers. Thereby contributing an infraction to port costs factor.

11.0. THE BREAKDOWN OFTHE 25Year REVENUE GENERATION ESTIMATES OF $200 COURTESY OF THE E-CUSTOM MODERNIZATION MODERNIZATION CONCESSION – REEMPHASISING ON ITS IMPLICATIONS :

HIGHLIGHTS OF THE PROJECT:

11.1. 1. $200,000,000,000:00b ÷ 25 Yrs = $8,000,000,000:00b. Per Annum.

Conversion @ 1$/#475.

2. #95,000,000,000,000:00Trillion ÷ 25Yrs =#3,800,000,000,000:00Trillion Per Annum.

3. $8,000,000,000:00b ÷ 12Months = -$667,000,000:00m Per month.

Conversion @ $1/#475:

4. #3,800,000,000,000:00Trillion ÷ 12Months = #316,825,000,000:00billion Per month.

11.2. SUMMARY OF E-CUSTOMS PROJECTED REVNUE GENERATION:

a). Monthly Revenue Projection =#316,825,000,000:00billion Per month/ -$667,000,000:00m Per month.

b).Yearly Revenue Projection = #3,800,000,000,000:00Trillion/ $8,000,000,000:00b

c). 25 Year Revenue Projection = #95,000,000,000,000:00Trillion / $200,000,000,000:00b

11.3. POSSIBLE DETERMINING FACTORS TO REVENUE FORECASTS OF THE CONSULTANT: The Projection is a probability owing to the following possible determining factors, which the consultant don’t have monopoly over it:

1. Foreign Exchange Administration.

2. Cargo Throughput forecast.

3. AfCTA Regime Implementation.

4. Government Fiscal Policy on trade.

5. Secured Supply Chain – Trade Compliance Questions.

11.4. ADMINISTRATIVE CHALLENGES:

1. Firstly, it is a common practice of the consultants to project an attractive and bogus revenue projection/forecast to earn government interests and patronage, afterwards they will start given reasons for not meeting its set targets in line with milestone actualization plan. A typical example is the projected aims and objectives of the port concession program of 2006.

2. Irrespective of the packaging of this project, it is a calculated and subtle return of the Nigeria Customs Service to a preshipment inspection regime, no matter the disguise of nomenclature, so applied.

3. From record, the consultant and technical partners does not have any track record of any nation where they have successfully undertaken such practices, as such it is going to be an experiment with the Nigeria Customs, invariably you can’t rule out teething problems and initial related crisis that will trail the commencement.

4. Judging from previous experiences, the key foreseeable crisis that will arise, on grounds of the trading public resistance to over valuation of trade goods, as the consultant is posed to achieve aggressive revenue generation without recourse to international best practices, but with kin and key interests focusing on its 1% comprehensive inspection scheme earnings collections.

5. The one and two above will trigger both trade/throughput disruption further the economic impact of inflation rate on the nation.

6. Only time shall tell.

CONCLUSION:

With the above independent assessment of the administrative impact of the former CGC of customs in the last 8 years to the port industry, this whole essence of this obligation is to sustain the culture of assessing the tenure of officials occupying heading essential agencies in the maritime industry.

While wishing the former CGC of Customs success in his future endeavors, we wish to congratulate the newly decorated Acting Comptroller General of Customs, Adewale Bashir Adeniyi, and to him we say: WELCOME TO A PROFESSIONAL CAREER CUSTOMS ADMINISTRATION REGIME.

Note that this Professional Assessment Position Paper Represents the strong opinion and position of the Sea Empowerment Research Center RGT’ undertaken for industry enhancement via references, comparative reviews and interactive engagements.

Thanks for your attention.

Fwdr Dr Eugene Nweke Rff Fnis Fptm Fffa Fasca Ksm.

@ Head Of Research – SEA EMPOWERMENT AND RESEARCH CENTRE RGT.

26th June 2023.

Ends

FOLLOW US