Customs e-Valuation, Benchmarking, NAC Levy and Anger at Ports

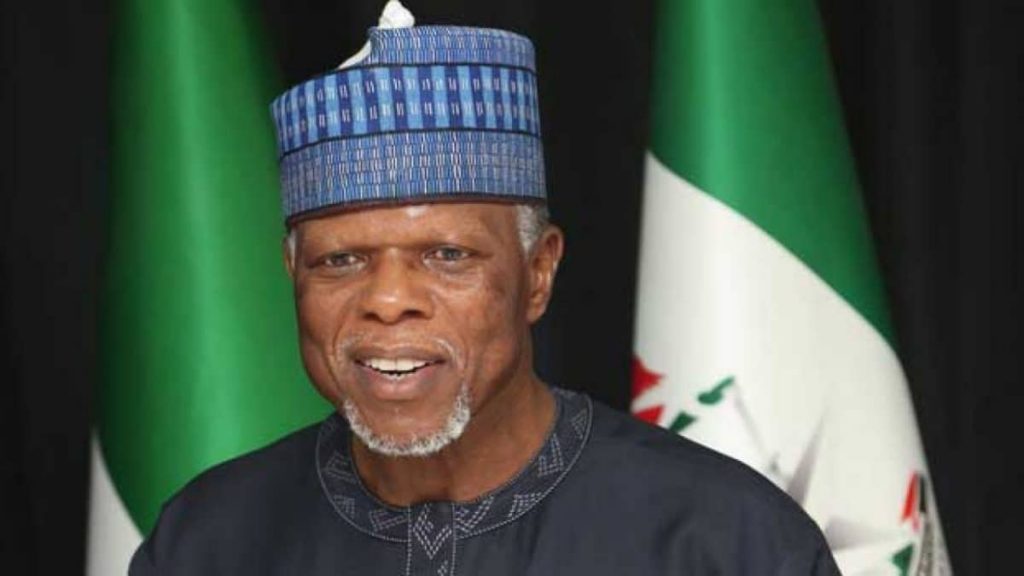

HAMMED ALI CUSTOMS CG

With a revenue target of N4.1trillion for the year, the policy of e-valuation, duty benchmarking and now 15 per cent National Automotive Council levy by the Nigeria Customs Service have all led to high duties at the ports, a development that has consequently drawn the anger of importers and their customs agents, writes Francis Ugwoke

Nigerians are currently on the eve of an election year. As some would say, the country is already on injury time as is common when any general election nears. To some extent, the 2023 election has started taking a toll on Nigerians, so to say. And for the whole year, it would be so until the election is decided early next year. The current impact is the heat on the economy as government appears to have put some viable sectors to task on increased revenue generation. The heat is beginning to spread. Many are wailing over rising costs of living, including the rich and the poor. While the rich may be worried about spending more, the poor are wailing over increasing hunger, perhaps, from once a day to close to nothing in a day. This indeed is a terrible situation. For those into international trade, the situation is very grim as profit margin has waned. Nigerian importers are part of the target and they are feeling the heat. Indications are that the federal government is expecting so much from the Nigeria Customs Service (NCS) through various taxes. This is evidenced by the high revenue target given to the Service to come from importers for this year. This is despite foreign exchange restrictions placed on goods under the 41list. Already, importers and their customs agents are beginning to feel the impact of about 300 percent increase in customs duties as against what was the situation before. So as imports suffer decline, it does not really matter to the government as the few Nigerians that are trading are taxed heavily to fill the gap. This paints the picture at the ports currently.

Customs Revenue Target

With a revenue generation of N2.23trillion last year from a target of N1.67trillion, the Customs Service this year set a target of N4.1trillion. This is N1trillion more than the N3.1trillion target that the House of Representatives Committee on Customs and Excise had set for it in January soon after its details of revenue generation for last year were made public. The new revenue target has been described as too high at a time that hard economic time has impacted negatively on imports. Observers believe that with the target the Customs will only end up over-stretching importers through various hikes in duty calculations. As if pre-determined, there have been signs of higher duties to be paid this year from late last year. The Service had enforced new duty rates on imports, ranging from bulk cargoes, containerized goods to Tokubo vehicles. The result has indeed been lamentation from the importers and customs agents. When importers pay high duties, they also look for ways to recoup it. This has in turn pushed up prices of goods in the market in the past few months.

Duty Bench Marking

Late last year, the Customs Service introduced duty benchmark under which it no longer calculated duties to be paid by importers on the basis of value of the goods as a global practice. Under this regime, the Customs assumes that the container and its content must be within a particular value range in the international market. Based on this, the Service can therefore decide that the duty to be paid must be like N5million for instance and cannot be calculated on the value of the goods. In other words, under the policy every 20ft or 40ft container pays a uniform duty rate irrespective of the value as contained on the invoice, a development that has been described as not done anywhere in the world.

Importers and customs agents argue that prices of goods in the international market depend on negotiation outside the advertised online price tags. But the Customs management insisted that this was the only way to check fraudulent practices by importers who are accused of under-valuing their goods in order to pay less duties. The Deputy National Public Relations Officer of the NCS, Mr Timi Bomodi defended the duty benchmarking on imported goods.

He insists that Customs Service has in its system data range on prices of goods internationally as guide. To him, the policy of benchmarking was introduced following cases of under-declaration, under-invoicing and concealment of goods by importers. Bomodi argues further, “The WCO nomenclature and the explanatory notes to the tariff are further guides which help agents and importers classify their goods correctly”, he said. Bomodi accuses agents of “misrepresenting facts with the obvious intention of evading the payment of appropriate customs duty”.

Many however argue that the problem of under-declaration, under-valuation have been there over the decades and wondered why the Customs Service kept quite until recently. To freight forwarders, the Customs deliberately introduced the policy for the purpose of meeting its target for the year. Many freight forwarders opined that the pressure on the Customs to generate more revenue was in connection with the 2023 election that requires so much funding.

To freight forwarders, the policy of customs benchmarking which started in the last quarter of 2021 was simply to achieve a multiplier revenue generation for the year. The former President of National Association of Government Approved Freight Forwarders, Dr. Eugene Nweke said the policy exposes the Customs Service as towing the line of illegality and unprofessionalism for the sake of more revenue generation. Nweke argued that this was without considering the consequences on Nigerians since importers will introduce higher prices to be able to recoup their investments. He argued that the policy throws to the wind professionalism and expectations of the valuation officers whose responsibility is to calculate duties based on the value of the goods before them. Nweke while condemning the decision said it will trigger inflation and bring more harm to the ailing economy than good. He called on the CGC Hameed Ali to save Nigerians such hardship by halting the policy of benchmarking.

Duties on Vehicles

Perhaps as part of the benchmarking policy was the duty hike on imported cars. The policy is known as Vehicle Identification Number (VIN) valuation under which duties on vehicles went up to about 300 percent. As against the rate in February when duty for instance in the case of a Corolla car was about N550,000, this has since changed. A customs agent said the current duty and cost of clearing a Corolla car for instance is N1.8million. This is outside the traditional settlements at the ports. The agent may decide to pay the money in a central unit from where the money will be transmitted to others or decide to ‘pay as you go’ (from the terminal to the gate, then others on the road outside the gate). This trend has made cost of vehicles and other goods very high. Now, there is hardly any clean Corolla car which market price is below N2.5million. This has in turn made the market very dull for traders. High cost of clearing, including duties payable also apply to other imported goods.

Protest by Customs Agents

Customs agents had in February protested against the VIN Policy, embarking on two weeks strike. With the effect of the strike, Customs Service had to suspend the policy promising a review after one month. The one month grace period ended on April 8 with importers and agents waiting on what happens next. But indications were that nothing was going to change going by the statement credited to the Comptroller General , Hameed Ali, who justified the VIN valuation policy. At a function before he went on annual leave, he made it clear that the Service would not stop the implementation VIN policy after the one month suspension. Ali was quoted saying, “It is now one valuation for the same type of vehicle anywhere. We are moving forward; we can’t be retrogressive. When the freight forwarders came up with their issue of not liking the platform I was surprised because these were the same people that put us on the edge. So, I think it has come to stay and we will make sure it succeeds. Anytime I come to the port, there has been this issue of uniformity for values. They have complained of multiple valuations when they go to Apapa port, Tin Can and PTML where they get different values”.

Dilemma

With the one month suspension on VIN valuation implementation over, it would appear there is confusion as to whether anything has changed or not based on Ali’s words. Just some days to the one month period, there was a report that the Customs had reduced duty payable on imported vehicles from 35% to 20%. As many were celebrating this, the Service cut short their joy saying that this was not true. Bomodi had said the report on duty reduction was simply a mix-up, but said it would be sorted out. About two weeks ago, the Customs introduced the new version of the Economic Community of West African States (ECOWAS) Common External Tariff (CET) as required by the World Customs Organization which will last from this year to 2026. Bomodi explains that under new policy and in line with the Finance Act and the National Automotive policy, NCS has “retained a duty rate of 20% for used vehicles as was transmitted by ECOWAS with a NAC levy of 15%. New vehicles will also pay a duty of 20% with a NAC levy of 20% as directed in Federal Ministry of Finance”. Observers believe that indeed the Customs boss has had his way since the duty to be paid on vehicles would still be high considering the 15 percent NAC levy. Aggrieved about the new NAC levy some customs agents are already considering embarking on a fresh protest.

The Chairman of the National Council of Managing Directors of Licensed Customs Agents, Ports & Terminal Multipurpose Limited chapter, Abayomi Duyile, was quoted saying this will have adverse effect on the industry. He argued that what Nigeria has were simply assembly plants as these companies hardly produce complete vehicles. He was quoted saying, “ I am surprised now that towards the second quarter of 2022, the Customs is coming back again with the NAC levy. Former President of National Association of Government Approved Freight Forwarders, Dr. Eugene Nweke argued that the Service has been unfair to the trading public challenging them to point out the economic impact of the 2 percent NAC levy that has been collected for over two decades before the current 15 percent hike. He argued further that the 16 percent NAC levy was a clear pointer to what he described as “the inherent administrative incoherence and confusion” on the part of the government. He challenged the government to offer the general public an analytical positive impact of the NAC levy considering that even with the payment the nation’s automobile industry has remained under-developed.

He argued, “the 2013 Automobile Policy leading to the issuance of permit to over 130 automobile plants, with its accompanying 35% Import Duty and 35% Levy on New vehicles and 35% Duty with 7.5% Vat on used vehicles have all been seen as defeated because most of the licensed automobile plants have turned to mere traders, in the face of increasing import volume for used and accidented vehicle, mostly so, where the intent of the policy was to evolve a mass production of quality and affordable vehicles for the Nigeria populace”

He argued “Without sounding immodest, this incessant auto policy is rather an administrative rigmarole and a defeat of objectives because when we compute both the negative impacts of the inherent over taxation tendencies of the auto policy formulations to the economy and its citizenry, it far outweighs the positive, especially in the context of job creation and local capacity development”.

*Culled from THISDAY NEWSPAPER

Nigerians are currently on the eve of an election year. As some would say, the country is already on injury time as is common when any general election nears. To some extent, the 2023 election has started taking a toll on Nigerians, so to say. And for the whole year, it would be so until the election is decided early next year. The current impact is the heat on the economy as government appears to have put some viable sectors to task on increased revenue generation. The heat is beginning to spread. Many are wailing over rising costs of living, including the rich and the poor. While the rich may be worried about spending more, the poor are wailing over increasing hunger, perhaps, from once a day to close to nothing in a day. This indeed is a terrible situation. For those into international trade, the situation is very grim as profit margin has waned. Nigerian importers are part of the target and they are feeling the heat. Indications are that the federal government is expecting so much from the Nigeria Customs Service (NCS) through various taxes. This is evidenced by the high revenue target given to the Service to come from importers for this year. This is despite foreign exchange restrictions placed on goods under the 41list. Already, importers and their customs agents are beginning to feel the impact of about 300 percent increase in customs duties as against what was the situation before. So as imports suffer decline, it does not really matter to the government as the few Nigerians that are trading are taxed heavily to fill the gap. This paints the picture at the ports currently.

Customs Revenue Target

With a revenue generation of N2.23trillion last year from a target of N1.67trillion, the Customs Service this year set a target of N4.1trillion. This is N1trillion more than the N3.1trillion target that the House of Representatives Committee on Customs and Excise had set for it in January soon after its details of revenue generation for last year were made public. The new revenue target has been described as too high at a time that hard economic time has impacted negatively on imports. Observers believe that with the target the Customs will only end up over-stretching importers through various hikes in duty calculations. As if pre-determined, there have been signs of higher duties to be paid this year from late last year. The Service had enforced new duty rates on imports, ranging from bulk cargoes, containerized goods to Tokubo vehicles. The result has indeed been lamentation from the importers and customs agents. When importers pay high duties, they also look for ways to recoup it. This has in turn pushed up prices of goods in the market in the past few months.

Duty Bench Marking

Late last year, the Customs Service introduced duty benchmark under which it no longer calculated duties to be paid by importers on the basis of value of the goods as a global practice. Under this regime, the Customs assumes that the container and its content must be within a particular value range in the international market. Based on this, the Service can therefore decide that the duty to be paid must be like N5million for instance and cannot be calculated on the value of the goods. In other words, under the policy every 20ft or 40ft container pays a uniform duty rate irrespective of the value as contained on the invoice, a development that has been described as not done anywhere in the world.

Importers and customs agents argue that prices of goods in the international market depend on negotiation outside the advertised online price tags. But the Customs management insisted that this was the only way to check fraudulent practices by importers who are accused of under-valuing their goods in order to pay less duties. The Deputy National Public Relations Officer of the NCS, Mr Timi Bomodi defended the duty benchmarking on imported goods.

He insists that Customs Service has in its system data range on prices of goods internationally as guide. To him, the policy of benchmarking was introduced following cases of under-declaration, under-invoicing and concealment of goods by importers. Bomodi argues further, “The WCO nomenclature and the explanatory notes to the tariff are further guides which help agents and importers classify their goods correctly”, he said. Bomodi accuses agents of “misrepresenting facts with the obvious intention of evading the payment of appropriate customs duty”.

Many however argue that the problem of under-declaration, under-valuation have been there over the decades and wondered why the Customs Service kept quite until recently. To freight forwarders, the Customs deliberately introduced the policy for the purpose of meeting its target for the year. Many freight forwarders opined that the pressure on the Customs to generate more revenue was in connection with the 2023 election that requires so much funding.

To freight forwarders, the policy of customs benchmarking which started in the last quarter of 2021 was simply to achieve a multiplier revenue generation for the year. The former President of National Association of Government Approved Freight Forwarders, Dr. Eugene Nweke said the policy exposes the Customs Service as towing the line of illegality and unprofessionalism for the sake of more revenue generation. Nweke argued that this was without considering the consequences on Nigerians since importers will introduce higher prices to be able to recoup their investments. He argued that the policy throws to the wind professionalism and expectations of the valuation officers whose responsibility is to calculate duties based on the value of the goods before them. Nweke while condemning the decision said it will trigger inflation and bring more harm to the ailing economy than good. He called on the CGC Hameed Ali to save Nigerians such hardship by halting the policy of benchmarking.

Duties on Vehicles

Perhaps as part of the benchmarking policy was the duty hike on imported cars. The policy is known as Vehicle Identification Number (VIN) valuation under which duties on vehicles went up to about 300 percent. As against the rate in February when duty for instance in the case of a Corolla car was about N550,000, this has since changed. A customs agent said the current duty and cost of clearing a Corolla car for instance is N1.8million. This is outside the traditional settlements at the ports. The agent may decide to pay the money in a central unit from where the money will be transmitted to others or decide to ‘pay as you go’ (from the terminal to the gate, then others on the road outside the gate). This trend has made cost of vehicles and other goods very high. Now, there is hardly any clean Corolla car which market price is below N2.5million. This has in turn made the market very dull for traders. High cost of clearing, including duties payable also apply to other imported goods.

Protest by Customs Agents

Customs agents had in February protested against the VIN Policy, embarking on two weeks strike. With the effect of the strike, Customs Service had to suspend the policy promising a review after one month. The one month grace period ended on April 8 with importers and agents waiting on what happens next. But indications were that nothing was going to change going by the statement credited to the Comptroller General , Hameed Ali, who justified the VIN valuation policy. At a function before he went on annual leave, he made it clear that the Service would not stop the implementation VIN policy after the one month suspension. Ali was quoted saying, “It is now one valuation for the same type of vehicle anywhere. We are moving forward; we can’t be retrogressive. When the freight forwarders came up with their issue of not liking the platform I was surprised because these were the same people that put us on the edge. So, I think it has come to stay and we will make sure it succeeds. Anytime I come to the port, there has been this issue of uniformity for values. They have complained of multiple valuations when they go to Apapa port, Tin Can and PTML where they get different values”.

Dilemma

With the one month suspension on VIN valuation implementation over, it would appear there is confusion as to whether anything has changed or not based on Ali’s words. Just some days to the one month period, there was a report that the Customs had reduced duty payable on imported vehicles from 35% to 20%. As many were celebrating this, the Service cut short their joy saying that this was not true. Bomodi had said the report on duty reduction was simply a mix-up, but said it would be sorted out. About two weeks ago, the Customs introduced the new version of the Economic Community of West African States (ECOWAS) Common External Tariff (CET) as required by the World Customs Organization which will last from this year to 2026. Bomodi explains that under new policy and in line with the Finance Act and the National Automotive policy, NCS has “retained a duty rate of 20% for used vehicles as was transmitted by ECOWAS with a NAC levy of 15%. New vehicles will also pay a duty of 20% with a NAC levy of 20% as directed in Federal Ministry of Finance”. Observers believe that indeed the Customs boss has had his way since the duty to be paid on vehicles would still be high considering the 15 percent NAC levy. Aggrieved about the new NAC levy some customs agents are already considering embarking on a fresh protest.

The Chairman of the National Council of Managing Directors of Licensed Customs Agents, Ports & Terminal Multipurpose Limited chapter, Abayomi Duyile, was quoted saying this will have adverse effect on the industry. He argued that what Nigeria has were simply assembly plants as these companies hardly produce complete vehicles. He was quoted saying, “ I am surprised now that towards the second quarter of 2022, the Customs is coming back again with the NAC levy. Former President of National Association of Government Approved Freight Forwarders, Dr. Eugene Nweke argued that the Service has been unfair to the trading public challenging them to point out the economic impact of the 2 percent NAC levy that has been collected for over two decades before the current 15 percent hike. He argued further that the 16 percent NAC levy was a clear pointer to what he described as “the inherent administrative incoherence and confusion” on the part of the government. He challenged the government to offer the general public an analytical positive impact of the NAC levy considering that even with the payment the nation’s automobile industry has remained under-developed.

He argued, “the 2013 Automobile Policy leading to the issuance of permit to over 130 automobile plants, with its accompanying 35% Import Duty and 35% Levy on New vehicles and 35% Duty with 7.5% Vat on used vehicles have all been seen as defeated because most of the licensed automobile plants have turned to mere traders, in the face of increasing import volume for used and accidented vehicle, mostly so, where the intent of the policy was to evolve a mass production of quality and affordable vehicles for the Nigeria populace”

He argued “Without sounding immodest, this incessant auto policy is rather an administrative rigmarole and a defeat of objectives because when we compute both the negative impacts of the inherent over taxation tendencies of the auto policy formulations to the economy and its citizenry, it far outweighs the positive, especially in the context of job creation and local capacity development”.

*Culled from THISDAY NEWSPAPER

FOLLOW US