Beyond Customs ‘Bumper’ Revenue Generation

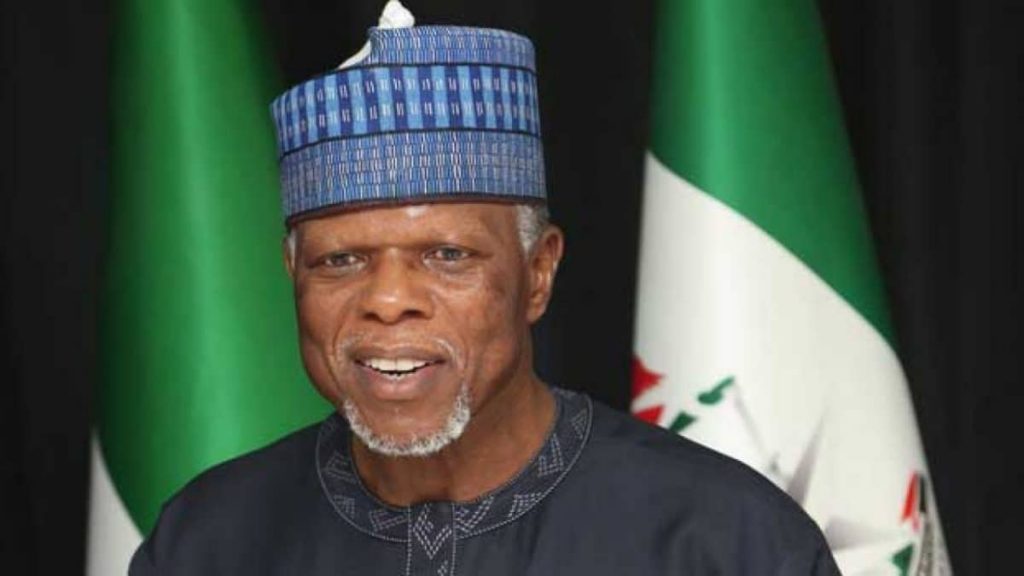

HAMMED ALI CUSTOMS CG

By Francis Ugwoke

The Nigeria Customs Service (NCS) is no doubt in celebration mood, beating its chest for a good business year in 2021. With a revenue target of N1.465 trillion it had earlier set for the year before the House Committee on Customs raised the figure to N1.679 trillion, the Service generated the sum of N2.24trillion. The Service had generated the sum of N1.5trillion in 2020 as against N1.3trillion in 2019. This indeed calls for celebration as it would appear that the present Comptroller-General, Rtd Col Hammed Ali, is living up to expectation in his national assignment. On appointment on August 27, 2015, Ali’s mandate was to reform and restructure the Customs Service to enhance its capacity for more revenue.There cannot be any doubt as to whether Ali has performed, but a lot leaves much to be desired. And this indeed is for obvious reasons. A chronicle of revenue generations over the years shows that there is hardly any year that the revenue of the customs does not rise. If not for anything, every Comptroller General works hard to ensure that he does not fall short of the revenue earlier generated in the previous year. That is the express order given to Customs Area Controllers manning different Commands. And so, progressively, the Commands have struggled to ensure that the revenue goes up even at the detriment of trade facilitation. This explains the various methods used by each Command to raise revenue. In the past 10 years, beginning from 2011, the records show rise in revenue each year. For instance, in 2011 – N741billion; 2012- N850.9 billion, 2013 – N833.4 billion, 2014- N977.09 billion , 2015- N903 billion, 2016 – N898.673 billion, 2017- N1.37tn, 2018 – N1.2 trillion, 2019 – N1.3 trillion, 2020 – N1.5 trillion and the sum of N2.24trillion in 2021. From the records so far, one can notice that except in 2013 during the tenure of Dikko Abdullahi there was revenue increase each year progressively. . However, the revenue fell in 2015 and 2016 during Ali’s tenure. But after then, there has been progressive rise each year in revenue in what has been attributed to the exchange rate factor. Between 2011 and 2014 when a dollar sold for between N155 to N165, the revenue was between N741billion and N977billion. Therefore, it would be clear that increase in revenue should not be regarded as a major achievement for any CGC. To observers, the present customs administration cannot be celebrating its revenue at N2.2trilion considering that the official exchange rate as at last year was over N400 and N550 per dollar. Compare that with the revenue figure of N977bn when the exchange rate to a dollar was about N160. With the Central Bank policy denying importers of 41 items foreign exchange, a good number of importers patronize the black market to remain in business. Only manufacturers and importers of pharmaceuticals and hospital equipment enjoy forex from the CBN.

Corruption

For observers who know the true situation at the nation’s ports, Hammed Ali should be assessed on how he has performed in addressing corruption in the nation’s ports and border stations where unscrupulous officers and importers are collaborators. Apparently aware of the ills in the ports system, Ali had declared ‘zero tolerance for indiscipline and corruption’ and threatened to dismiss and prosecute officers caught in the web. His words as at December 2015 were , “I want to make it clear to all of you that I have zero tolerance for indiscipline and corruption. I will dismiss and jail any officer found guilty of such. Indiscipline will no longer have a place in the NCS. We must have officers and men with impeccable character to promote the image of the service. Anyone caught falsifying any documents or compromising with fake imported goods will also be dismissed and jailed. “The NCS has resolved that anyone caught in an unprofessional conduct, no matter the circumstances, will be dismissed and jailed for the offence.’’

It was laughable when the Customs CG talked of zero-tolerance to corruption among officers. But in trying to keep to his words, the Customs had in October 2016 dismissed 29 officers for various offences capable of ‘compromising national economy and security’. The 29 officers were sacked over “gross misconduct, forgery, corruption, bribery”. Few other officers have also been affected.

However, beyond this action by the CG, the NCS has failed in a number of ways in addressing corruption in the ports involving officers. Talking about corruption in the ports, what could be clear is that this starts from the importers of the goods who naturally as businessmen would want to maximize their profit margins. These importers are involved in under-declaration, concealment and under-invoicing. The Customs therefore is seen as having been empowered under statutory obligation to check these importers. But for most Customs officers, these are avenues to also make money for themselves. So instead of taking drastic actions as capable of ending such trade crime, the officers go into negotiation in which the importers are compelled to settle them after being awarded a Debit Note (DN) penalty. In defence of their activities, importers complain that one of the reasons why trade crime remains in the ports is that even with clean import in which no crime is committed, the importer is still delayed by customs personnel during the process of clearing in a bid to be settled before the goods are released. Apart from settlement at different units, including exits gates, frivolous debit alerts on containers are the order of the day. As the former ANLCA President, Prince Olayiwola Shittu put it.. “So you don’t even know at what stage your compliance level is acceptable. How do you determine somebody is compliant or not, because when you are even compliant, you are a very honest person, am talking of the importer, you don’t want cut any corner, let me just pay my money to the government and go away, you are still subjected to all those pitfalls – all those mountains you need to cross because somebody wants to extort from you. So that is why people say, cash 2-2, if I am okay I will suffer, if am not okay, I will suffer, let me suffer once. You know that this trading we are talking about is competition – the lower the cost of bringing out your goods the better for you in competition with your colleagues….”

The point therefore is that in the ports system, the Customs Service under Hammed Ali should be in a position to end all forms of fraudulent practices by first ensuring that the right thing is done by importers. This is the reform that is so much required. If importers who are flagrant of trade malpractices are punished, it would indeed force others to sit up in a matter of few months. But for as long as some customs officers look the other way and collect settlement, the fraudulent importers will never change. When an importer observes all the trade regulations, he has no reason to settle any customs officer. This indeed is part of the change that the present Customs management under Ali should introduce.

Duty Benchmarking

Nigeria is currently in bad shape as far as the economy is concerned. The implication is that there is so much pressure on revenue generating agencies to perform. It could be for this reason that the Customs leadership has decided to introduce all forms of measures to raise revenue. This includes the introduction of duty benchmarking as at September this year on imported goods under claim to check fraudulent declarations.

Under the duty benchmarking policy every 20ft or 40ft container pays a uniform duty rate irrespective of the value of the imported goods, a development that has been described as not done anywhere in the world.

The Service argues that it has in its system data range on prices of goods internationally as guide. But this is with a lot of consequences for the general economy which the Customs Service may have ignored. When an importer spends so much to clear his goods, he definitely must increase the prices of his goods to recoup his investment. Certainly, he cannot be the loser. It is the final consumers that now suffer the effect of such policies. This is the point that the customs management should bear in mind when it insists on duty benchmarking instead of allowing the true value of the goods to determine the duty to be paid by importers. Observers believe that the idea is to achieve a multiplier revenue generation for the Customs Service.

But industry stakeholders argue that the measure exposes the Customs Service as towing the line of illegality and unprofessionalism for the sake of more revenue generation without considering the consequences on Nigerians.

Some freight forwarders said this policy throws to the wind professionalism as far as expectations of the officers of the Service are concerned.

Former President of the National Association of Government Approved Freight Forwarders (NAGAFF), Dr. Eugene Nweke while condemning the decision said it will trigger inflations and bring more harm to the ailing economy. Nweke said the CGC should save Nigerians such hardship and halt the internal directive on the duty benchmarking.

Many believe that what Ali should do before leaving office is to ensure that importers who chose the path of illegality face the consequences. This also means that the CG should aim at getting officers to shun trade crime induced settlement at the ports or border stations. This will pay the country more with increased revenue. It will equally enthrone discipline and sanity in the system. It will end decades of corrupt practices in the ports in which many customs officers, customs agents and importers have remained beneficiaries in a system that inflicts undue hardship to the final consumers in the market. The CG should also aim at ensuring that automation in the real sense is introduced in the ports to reduce human contact with customs officers as is the case in other climes. Customs is indeed doing its best as far as war against smuggling is concerned with billions of Naira worth of seizures declared each year, but the truth remains that aiming for high revenue at all costs without considering some of the economic consequences cannot be the best. The Customs should also be aware of the exchange rate factor in what appears to be a high revenue generation. It would be self deception to ignore this. As part of promoting trade facilitation as in other climes, the CG should ensure that all the ports get scanners to facilitate fast clearance of goods. Experience has shown that manual examination as good as it is in some cases is not without extortion as no container can ever be examined without the importer settling the officers for favourable reports, most times, whether good or bad. Incidentally, the importer still has the valuation officers and other departments to contend with as he receives various alerts. Ali’s legacy should be for being able to address these issues in the ports.